AI Modalities in Finance and Accounting

(This article was originally posted on LinkedIn here.)

Introduction

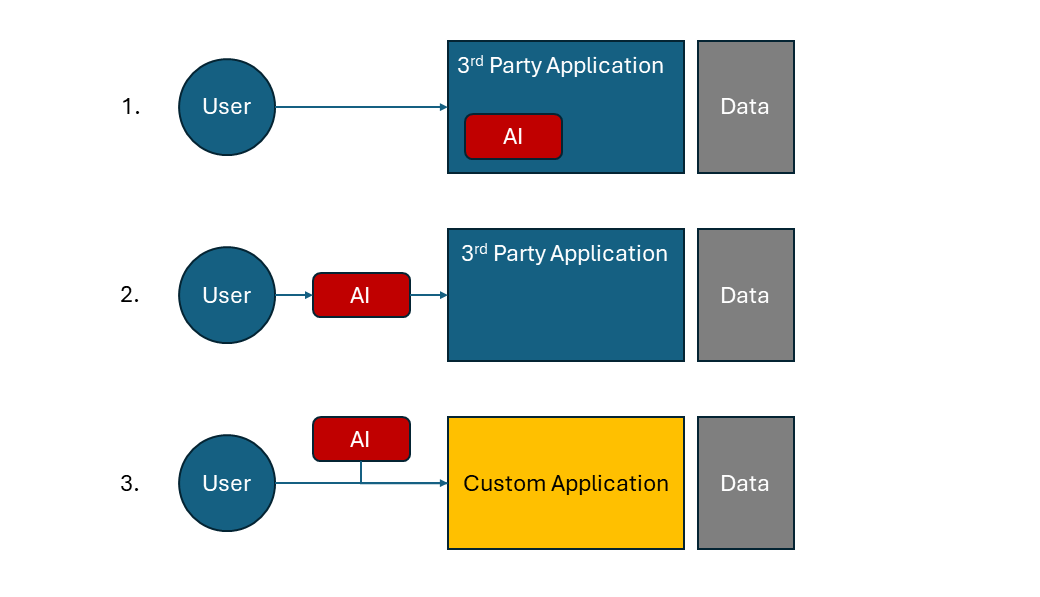

Figure 1: Use cases for AI within existing and custom applications

The typical characteristics of finance and accounting such as repeating processes, structured workflows with numerical data and rules-based compliance are generally well-suited to automation and consequently the sector has become a major target for platform developers looking to leverage the recent evolutions in Artificial Intelligence (AI).

The industry is seeing a lot of innovation and focus in augmenting and improving existing applications. One related area of interest is to what degree finance users can leverage the increased development potential of AI tools in building custom applications.

In exploring how AI and LLMs could be used across various use cases in finance and accounting it’s helpful to construct a framework for categorizing the user perspectives, as shown in the figure above.

1. Embedded AI

This first use case is emblematic of much of the ongoing development in the ecosystem: AI embedded within a current third-party application. Existing products that have established user bases and proven utility seek to incrementally improve performance and user experience by integrating AI carefully into subsets of the platform. The user is either explicitly aware of the presence of AI or just experiences an improved quality of performance from AI within the product.

Many of the examples here target efficiency improvement in bookkeeping, transaction reconciliation, order-to-cash management, month close management, identifying trends or discrepancies and so on across different segments of the finance and accounting architecture.

2. AI as a Co-Pilot

A second use case is where the user has a separate AI instance, or ‘copilot’, that works directly with an existing third-party application. The copilot could be a generic off-the-shelf model or a model tailored through fine-tuning on industry or proprietary data. The model integrates with current applications usually via APIs to augment or wholly replace the default user interface. Recent evolutions in LLM architectures has seen techniques such as Retrieval Augmented Generation (RAG) used with generative AI to obtain information and work with databases and external applications.

Much of the finance industry is justifiably concerned about preserving confidentiality of data and it’s not abundantly clear how the major foundation model providers will address this, particularly for small-scale use. Self-hosted LLM infrastructure, or a dedicated enterprise environment, can solve for the confidentiality issue but costs are generally out-with the reach of small business or early-stage platforms.

However, open-source LLMs, trained for specific task sets, are emerging as very viable solutions in this space and are of a scale that can be hosted on a local computer or small-scale cloud infrastructure. Such hosting enables encapsulation of the data and associated applications within controlled environments and at a low cost which is attractive and feasible for small businesses. We could see such usage of specialized self-hosted models as copilots for finance and accounting teams expand significantly.

3. Custom Applications Using AI

A third use case recognizes the potential for finance users to leverage the increased productivity from self-development of applications, script processing or more complex interactive applications.

Github Copilot, itself a proven use of AI in an enterprise environment, has changed software development, partly by improving existing developers' productivity but also by enabling non-career developers to create applications within a reasonable timeframe.

Finance leaders tend to be very skilled in Excel and those computational skills are very transferable to software languages such as Python. The wide variety of libraries in the Python ecosystem–streamlit, pandas, matplotlib and many others, have long been useful in data science and analytics, and more complex applications are now within reach of the occasional developer.

Low-code and no-code approaches have existed for a while, but are inherently less flexible and also are platform-restricted: the generated design is specific to the coding platform itself. Development using common, open languages could see applications and ideas shared between finance leaders on a much more open basis.

Powerful analytical databases are also now within reach of the individual user. Zetta Venture Partners, in their AI predictions for 2024, highlighted DuckDB as able to “turn your laptop into a personal analytics engine”. GPT-3.5, GPT-4 and other models are surprisingly good at generating SQL queries based on database schema and user description of the analysis goals, making custom database applications more feasible on a small scale.

Custom finance applications could span the spectrum from in-depth data visualization, generation of tabular data summaries from the general ledger and other databases, generation of financial narratives and stakeholder reporting along with accompanying data, automated responses to compliance and vendor questionnaires and so on. Of course, developing anything of this nature would involve attention to initial requirements, validation against test sets and maintenance if the availability and integrity of the application are to be preserved.

Across the AI Spectrum

In the wider ecosystem we will see some really powerful solutions coming from the first and second use cases described above, with AI integrated into existing platforms or as a separate, application specific co-pilot. A host of new companies has emerged in recent months to focus on these opportunities, and even with existing platforms there has been a multitude of new AI-enabled functions. Also compelling will be the evolutions we see in finance leaders developing their own, and within their teams, custom toolsets to tackle unique requirements of their companies, leveraging both the improved development productivity of AI and LLMs and utility of both in applications.